The information contained herein was prepared between September and October 2024.

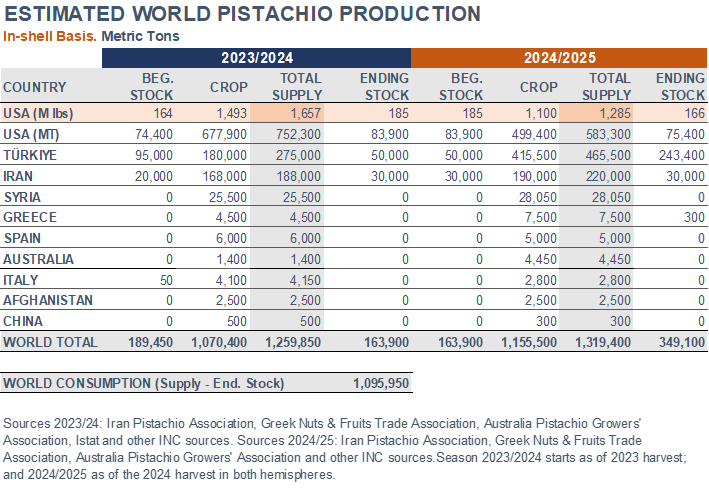

USA. Total shipments at the end of crop year 2023/24 were a record-setting 535,870 metric tons (1.2 billion pounds), a 31% increase from the prior record shipment of 409,087 MT (902 million lbs.) for the 2022/23 crop year. Shipments saw a significant increase due to several key factors. There was a notable rise in demand from international markets, particularly Europe and China. Europe saw shipments increase from 88,400 MT (195 M lbs.) in 2022/23 to 133,300 MT (294 M lbs.) in 2023/24. China saw shipments rise from 95,200 MT (210 M lbs.) to 165,100 MT (364 M lbs.) for the same years. Limited supply from Iran also helped sustain good demand from the Middle East and India throughout the year. Yields were also favorable for 2023/24, with a crop size of 678,000 MT (1.5 B lbs.), ensuring that there was enough supply to meet the heightened demand. Crop size for the upcoming 2024/25 crop year is considered an off year, estimated to be 499,000 MT (1.1 B lbs.). Early harvest receipts indicate good quality with relatively low stain levels.

Türkiye. Harvest of the largest-ever Turkish crop started in late July and was still ongoing by mid-September with no incidents reported. Kernel quality was good, and the early-harvest batches had already been shipped at the time of this report. Due to the large crop, the average size of pistachios this year is smaller, with an expected size range of 34/36.

This bumper crop has sparked interest from major consumer regions, where there was strong anticipation of a sharp price reduction. Kernel prices have already been adjusted downward. However, in-shell pistachios were still priced on the higher side. In comparison to the anticipated export volumes, the domestic market was expected to remain relatively stable throughout the year.

Iran. The Iran Pistachio Association adjusted the 2023/24 crop estimate to 168,000 MT and announced the 2024/25 crop forecast at 190,000 MT. The harvest began in mid-September and was expected to extend for a longer duration than usual. There were reports of higher-than-usual blanks and heat damage due to excessive summer temperatures and daily irrigation interruptions caused by widespread electricity shortages in the country. This will probably result in a downward revision of the 2024/25 crop forecast.

The 2023/24 marketing year closed with total exports of 133,000 MT (in-shell equivalent) and total domestic consumption was estimated at 25,000 MT. Export shipments during the summer exceeded expectations, averaging 10,000 MT monthly and reaching more than double the level of the same period in the previous year. In the last marketing month (August 23 – September 22), driven by Diwali demand, India led shipments at ca. 2,000 MT. Overall, shipments to the Indian subcontinent remained strong, with kernel shipments growing during the latter half of the 2023/24 crop year. Kernels and green peeled pistachio kernels (GPPK) accounted for 42% of this year’s export shipments, compared to a four-year average of 35%. Demand for GPPK has been robust, with shipments to non-European destinations increasing throughout the year and adding up to about 40% of GPPK shipments.

Spain. Supply is expected to be more limited this season, primarily due to unfavorable weather conditions during blooming, coupled with 2024/25 being an off year. Additionally, new processing plants are emerging each year, with around 70 facilities now operating in the country.

Australia. The initial estimate for the 2025 crop, set to be harvested in March, is projected to range between 3,000 MT and 3,500 MT. Domestic pistachio consumption has seen a 7% increase over the past financial year, following two years of stagnant demand.