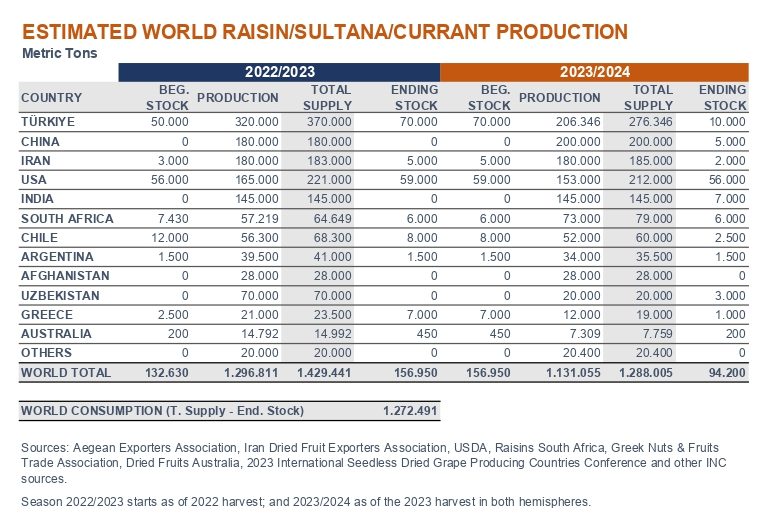

Türkiye: The Aegean Exporters’ Association revised the 2023/24 dried grape production down to 206,300 metric tons, 36% below season 2022/23, as this year the grape crop was affected by heavy rainfalls in Manisa around harvesting time.

Total export shipments in 2022/23 marketing year (September 1, 2022–August 26, 2023) amounted to 256,000 MT, 2% up from 2021/22. Europe was the main export market, with 132,557 MT, which represent 52% of the total share and a growth of 5% vs. 2022. Germany (52,935 MT) and the Netherlands (51,207 MT) were the leading importers, followed by Italy (28,936 MT), France (26,238 MT) and Spain (15,400 MT). Year-to-date exports (September 1–October 14, 2023) added up to 36,834 MT, 5% down from the same period in 2022/23, with Europe accounting for 96% of the market share.

Iran: As per the Iran Dried Fruit Exporters Association, the whole grape growing region in Iran experienced a hard winter, which reduced grape clusters to varying degrees, while higher size and quality were reported.

At the time of writing this report, the 2023/24 production was forecasted at 180,000 MT, with domestic consumption ranging from 40,000 to 50,000 MT and export shipments expected to add up to between 130,000 MT and 140,000 MT. Total production comprised 50% Golden, 35% Sultana and 15% Thompson & Green.

China: Total production in 2023 is estimated 11% up from 2022, at around 200,000 MT. The Xinjiang producing region saw some frost damage last April, but only north of the Flaming Mountain, where the crop was about 20-30% below last year, but offset by the southern crop, which was about 30% above. Both Chinese Sultanas and green raisin quality was very good due to cool weather.

While, at the time of this writing, the price of green raisins was on the lower side owing to weak domestic demand, and raisin prices were not covering production costs, Chinese Sultanas were at a higher level as the Turkish production was affected by rain during harvesting time.

USA: Rain and cooler temperatures in the spring and early summer and cooler weather during the drying season (especially in September and October) delayed the harvest for raisins by about three to four weeks. Due to adverse weather during the growing and drying seasons, this year’s production is forecasted at 153,000 MT, down 7% from 2022/23.

The combination of the 2023 crop and carryover from last year’s crop should be enough to meet total demand. Shipments during the summer months have been traditionally slow and expectations are that shipments will start to creep up in preparation for the year-end holidays.

South Africa: As reported by Raisins South Africa, following a very cold winter, as of September, the producing regions were entering a sensitive period, with vineyards moving into budbreak stage, with low to medium frost risk weather forecasts. Some frost damage was reported for the week of September 4-11, 2023, although only limited to early cultivars and specific areas of the Orange River; the extent of damage was still being assessed at the time of writing this report. In terms of outlook, vineyards have recovered from the past two years’ wet seasons with final volumes only just exceeding the 60,000 MT mark and it is anticipated that crop size will recover to more than 75,000 MT.

Export shipments to the top 12 destinations were down by only 1% from last year. Given the current world economic state, the industry remains optimistic that the global economy would recover slowly over the next 12-24 months. The currant market is under pressure, with slow movement of currant volumes.