The information contained herein was prepared between mid-January and February 2025.

Türkiye. As reported by the Aegean Exporters’ Association, 2024/25 year-to-date international shipments of seedless raisins (September 1, 2024 – February 1, 2025) totaled 77,062 metric tons, marking a 31% decline from the same period in 2023/24. However, total export value rose by 17%, reaching US$271.7 million compared to US$231.9 million.

Europe remains the largest market, accounting for 40,866 MT —a 31% decrease from 2023/24— but with a 17% increase in total value, rising from US$124.9 million to US$146.7 million. The leading importers within Europe were the Netherlands (10,168 MT), Italy (8,115 MT) and Germany (6,623 MT). The UK continues to be the top single market, importing 22,540 MT —down 12% from the previous season— while the total value surged by 60%, reaching US$77.6 million compared to US$48.6 million.

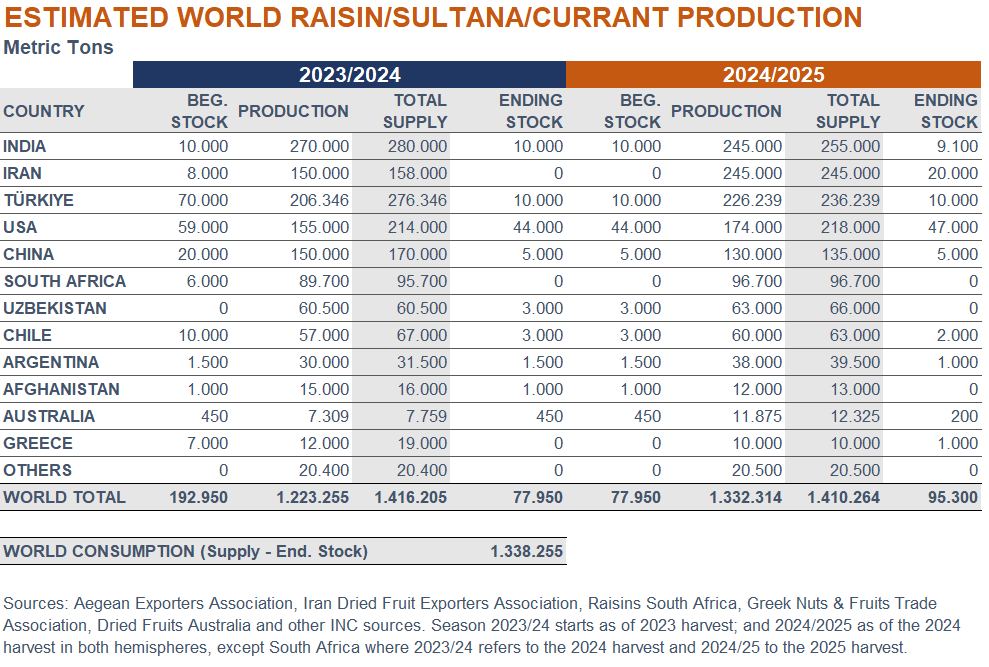

Iran. As per the Iran Dried Fruit Exporters Association, the 2024/25 production was revised to 245,000 MT. Considering an expected ending stock of 20,000 MT and a local consumption of around 50,000 MT, this leaves 175,000 MT available for export. Out of this exportable amount, 80,000 MT were utilized through December 2024.

USA. As of the reporting period, deliveries of the 2024/25 crop had begun to slow, with growers shifting their focus to preparations for the 2025/26 season. In California’s raisin-growing region, late fall through mid-spring marks the rainy season, with an anticipated annual rainfall of approximately 11 inches (280 mm). The 2024/25 crop is of excellent quality, thanks to the ideal growing and drying conditions experienced throughout the season.

Shipments of the new crop started last October and are expected to continue through late next fall. With 2024/25 production projected to surpass the previous season, shipments were expected to pick up in early 2025.

China. The 2024/25 production has encountered challenges, with a smaller crop and lower quality affecting market dynamics. In the largest raisin-processing area, Turpan (Xinjiang Province), high temperatures in early summer disrupted fruit pollination, leading to reduced yields, as reported by the USDA FAS. While the marketing year 2023/24 started with 20,000 MT of stock, owing to weak local demand, exports hit a record high, resulting in a short ending stock, estimated at 5,000 MT. Stock is also expected to remain at a low level in 2024/25 due to the shorter production.

With raw material stock nearly depleted, as of this report, prices for Chinese green raisins showed an increase of approximately 8–10% compared to last year. Meanwhile, the price of Sultana raisins climbed by over 50%. Domestic sales remain sluggish.

South Africa. At the time of reporting, the current crop was looking very promising, with farmers’ stock ranging between 90,000 MT and 110,000 MT, which equals approximately 97,000 MT of marketable product. No adverse weather conditions have been observed, and harvesting of raisin cultivars was expected to start from January 20, 2025. Excellent drying conditions with low to no rain were anticipated for January and February.

The total tonnage of raisins exported in 2024 has seen an increase year on year of about 40%, amounting to 77,991 MT.

Australia. As reported by Dried Fruits Australia, the spring bud burst period of 2024 benefited from ideal climate conditions, creating a strong foundation for a fruitful 2025 crop across all varieties. Additionally, near-perfect drying conditions have accelerated the harvest season, which is a highly positive development.

The forecast for the 2025 crop intake volume is promising, expected to exceed 15,000 MT, representing a 30% increase compared to 2024. In terms of quality, the overall outlook remains good, with only minor sunburn impact observed. As of this report, market conditions continued to be favorable, reinforcing optimism for a successful 2025 season ahead.