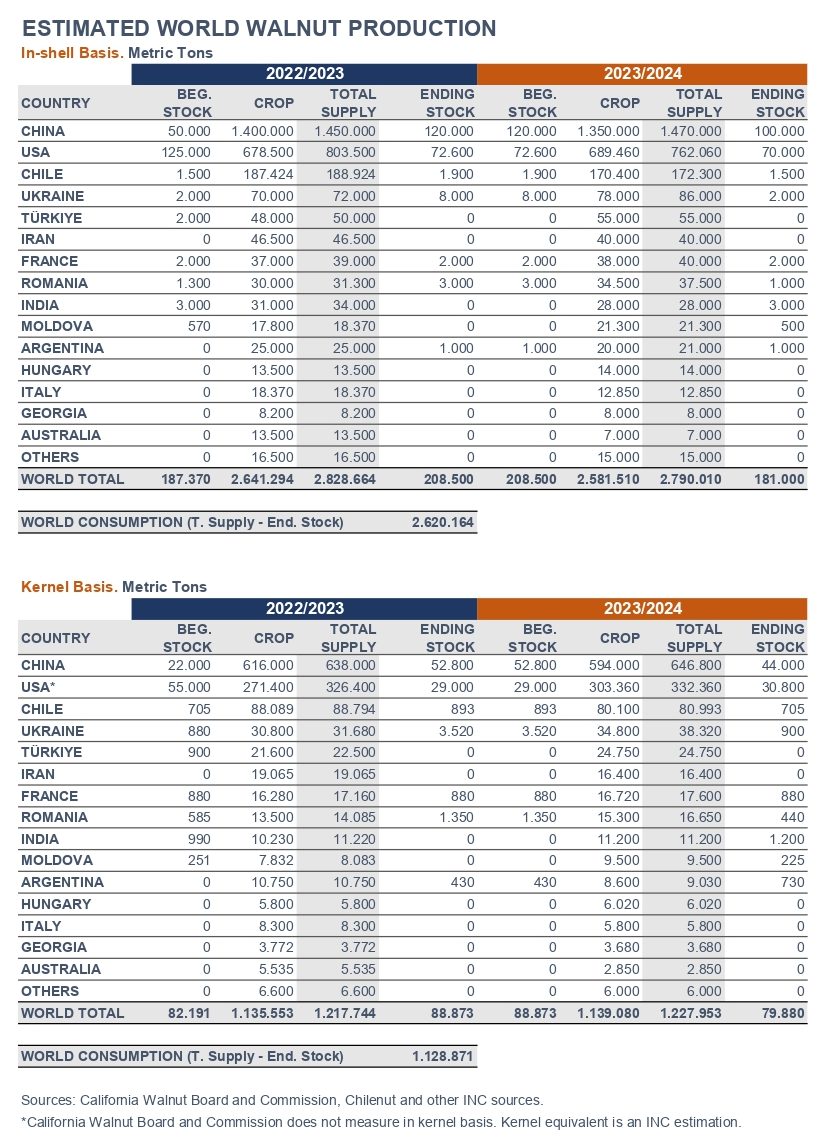

China: With the harvest coming to a close by late October, the crop estimate was revised from the initial forecast of 1.45 million metric tons down to 1.35 M MT (in-shell basis). The crop was widely impacted by frost in the Xinjiang, Shanxi, Shaanxi, Gansu and Hebei growing regions and by drought in Yunnan. Furthermore, in mountainous and hilly areas, the crop has only been partially harvested due to abandonment and lack of labor.

Record overseas shipment at the start of the season combined with the reduced crop are likely to keep the market firmer throughout the season. The crisp fall weather during harvest has ensured good quality. The final receipts volume will largely depend on the farm-gate pricing.

USA: The USDA National Agricultural Statistics Service’s (NASS) has lowered the 2023/2024 crop estimate down to 760,000 short tons (689,460 MT) —a 30,000 ST reduction from the previous forecast. This is due to a restatement of producing acres down to 375,000 (ca. 151,800 hectares), based on information the California Walnut Commission & Board received from Land IQ, which does not take into consideration acres that appear to be abandoned or stressed, which could lower the crop size further. There will be another acreage update (producing, non-bearing, removals) in early November, likely reflecting fewer producing acres.

Chill hours were adequate and a wet winter and spring helped restore soil moisture in walnut orchards across the state. Thus, this year’s crop is expected to be of exceptional quality. Harvest began in mid-September and may extend into November due to the early season cooler temperatures.

Chile: As reported by Chilenut, 2023 has become a record-breaking year in terms of shipments, driven by surging demand from India. Export shipments year to date (March 21–September 30, 2023) amounted to 130,883 MT (in-shell equivalent), 8% up from previous year. While shelled walnut exports have seen a 9% decrease, amounting to 42,700 MT, in-shell exports have increased by 18%, reaching 88,200 MT.