The information contained herein was prepared between mid-January and February 2025.

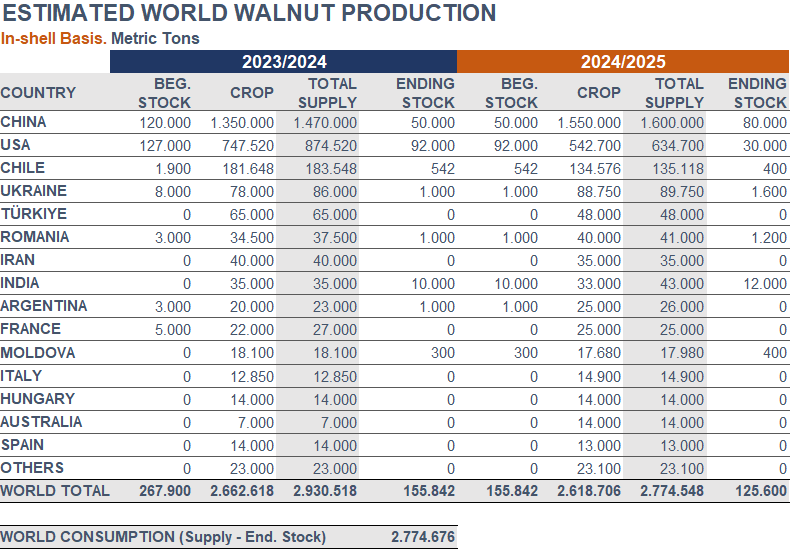

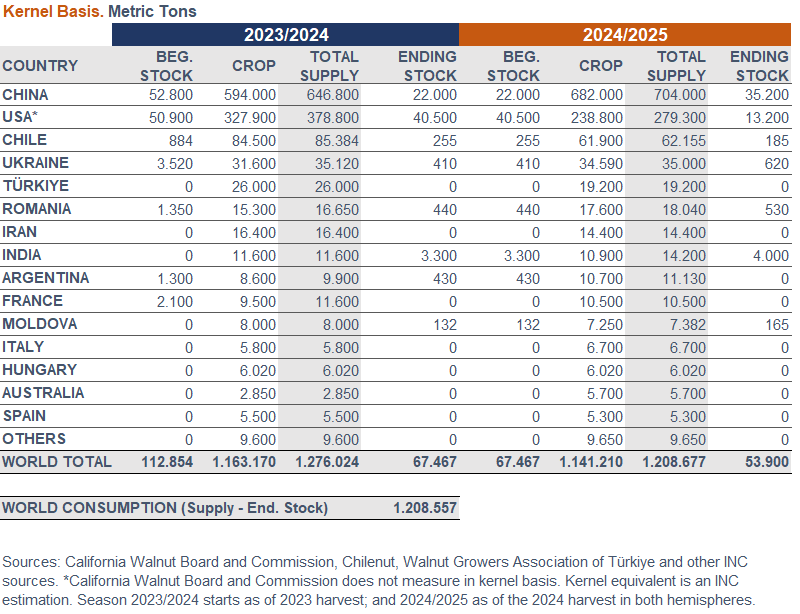

China. The early crop forecast was revised upward to 1.55 million metric tons (in-shell basis), 15% up from 2023/24, due to favorable weather. Between September and November 2024, in-shell exports surged 97% to 113,327 MT and shelled exports rose 77% vs. 2023 to 35,698 MT.

In early 2025, prices remained firm amid robust demand ahead of the Spring Festival. The market was expected to stay strong as premium variety stocks were quickly being depleted, tightening supply before the next harvest.

USA. As reported by the California Walnut Board and Commission, shipments through January 2025 have been robust across Asia and Europe, matching or exceeding shipments from last year’s record crop. With a shorter 2024 crop, very little uncommitted carry-out is anticipated.

Heavy precipitation in Northern California through December contributed to replenishing reservoirs, while January’s cold, dry weather provided sufficient chilling hours. With 67% of existing acreage being 19 years old or younger, denser plantings and vigorous trees are expected to provide a reliable supply into the future.

Chile. As reported by Chilenut, a strong harvest is anticipated in 2025. Despite a reduced planted area of 41,700 hectares, favorable conditions are expected to drive production to around 168,200 MT.