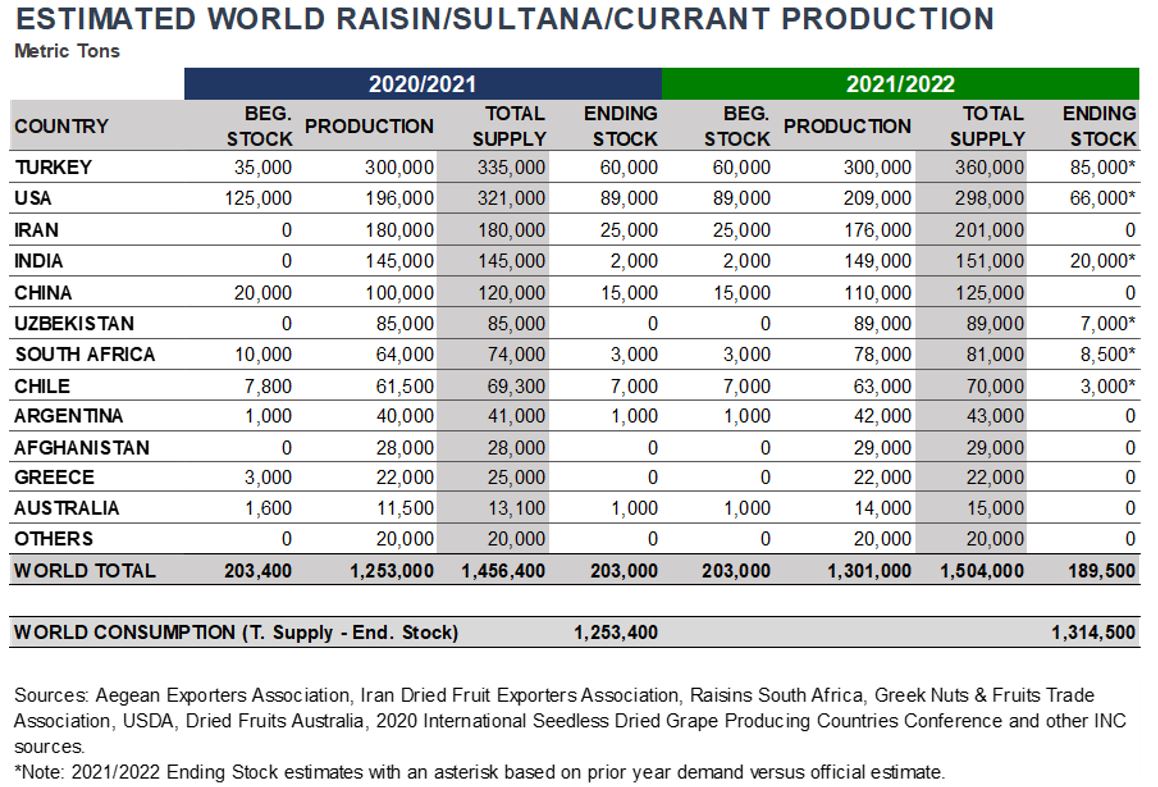

As discussed during the latest INC Online Conference, held during May 25-27, total dried grape (raisins, Sultanas and currants) supply in 2021/2022 is forecasted to remain fairly stable (3% up from 2020/21), as planted areas are not expanding in the top production origins. The beginning stock in 2020 was around 203,400 metric tons and it is estimated to be roughly the same in 2021 (203,000 MT). Carry out for the 2021/22 season, preliminary forecasted 7% below compared to 2021/22, at 189,500 MT, is optimistic from a sales standpoint. There is not a big shift in supply expected for any of the major suppliers.

On the demand side, although 2020 did see a big raise in retail consumption, it was traded off by the drop in HORECA sales. Due to normalizing and opening up after the pandemic, a slight increase in demand is projected for the incoming months.

Turkey

According to the Turkish Statistical Institute data, international shipments from January to April were reduced from 77,388 MT in 2020 to 63,240 in 2021, about 18%. This could be partly due to the COVID-19 aftermath as well as the shipping disruptions. However, most of the 60,000 MT of carry-over is mainly composed of the fruit bought by TMO.

USA

As per the USDA Global Agricultural Trade System (GATS) database, international shipments out of California year to date (January-April, 2021) were slightly reduced by 8% to 26,083 MT from the 28,398 MT exported during the same period in 2020. However, exports to Taiwan (1,593 MT), the Philippines (1,508 MT) and South Korea (1,158 MT), were significantly increased by 71%, 53%, and 51%, respectively from the last year.

China

South Africa

Due to the smaller-than-average crop in 2020, the total stock inventory is expected to be almost fully sold out, so, opening stock for the 2021/22 season is currently estimated at 3,000 MT. The early production guestimates for this season place the farmer stock production at around 86,000 MT, with 78,000 MT of marketable product, as production is expected to come back to normal volumes.