Turkey Hazelnut Crop Progress Report

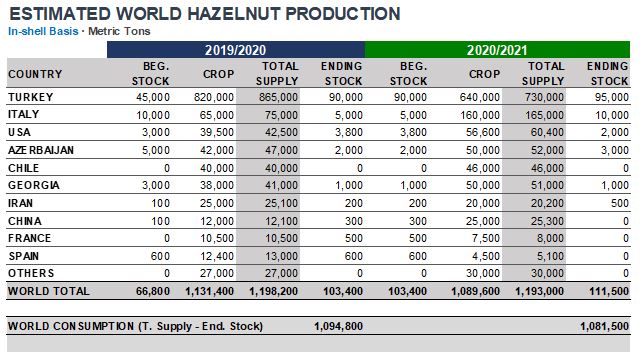

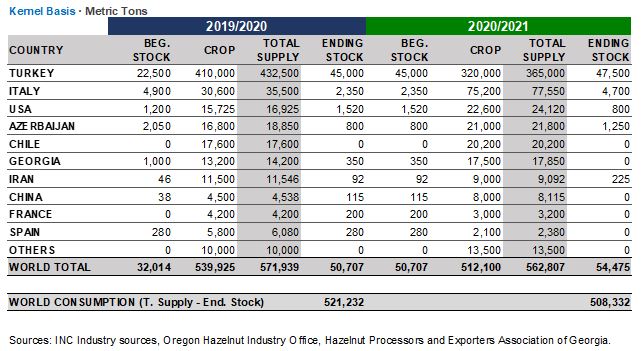

The season has started with high expectations from the majority of the farmers and trading community, where reluctance to sell and TL devaluation spree during September- November kept TL prices approximately 15% higher than the opening levels. However, with higher than expected carry over in the industry, cautious procurement policies and slower demand due to pandemic-related household economic concerns, the holiday season in lockdown and lower consumer confidence, TL prices lost steam and returned almost at the beginning levels. Higher than usual crop levels in Italy, the US, and Caucasian countries also decreased the overall demand from Turkey. It is the common belief that the majority of the remaining crop is mostly under the ownership of the farmers. As the 2021 season indicates, warm winter is closely watched for drought and early rejuvenation of the orchards. However, currently, male blooming and farm maintenance performances are quite promising.

Italy Hazelnut Crop Progress Report

The crop ended up even higher than anticipated. The estimate for 2020/21 was consolidated at 160,000 MT in-shell, 19% up above the initial forecast, and presented excellent quality. By the end of last year, 50% of the crop had already been processed and sold and the bumper crop compensated for the lower prices.

USA Hazelnut Crop Progress Report

The 2020 crop was superb both in terms of quantity and quality; it was a very low defect-year with minimal disease, mold, or insect pressure.

The pandemic continues to present production challenges, although the crop was still all processed in time as to not interrupt production. On a positive note, the “channel-switching” that has occurred across many products may very well provide an opening for new uses for Oregon’s ever-increasing supply of kernels. Traditional in-shell markets, particularly in Asia, were reduced this year as compared to the historical average. The trade challenges between the US and China continue to hamper volumes headed into this channel. Meanwhile, stable kernel demand warranted much of the crop to be shelled. Overall volumes shipped have been typical with other crops, however, with kernel making up a larger percentage than normal.

The pandemic continues to present production challenges, although the crop was still all processed in time as to not interrupt production. On a positive note, the “channel-switching” that has occurred across many products may very well provide an opening for new uses for Oregon’s ever-increasing supply of kernels. Traditional in-shell markets, particularly in Asia, were reduced this year as compared to the historical average. The trade challenges between the US and China continue to hamper volumes headed into this channel. Meanwhile, stable kernel demand warranted much of the crop to be shelled. Overall volumes shipped have been typical with other crops, however, with kernel making up a larger percentage than normal.