Almonds USA

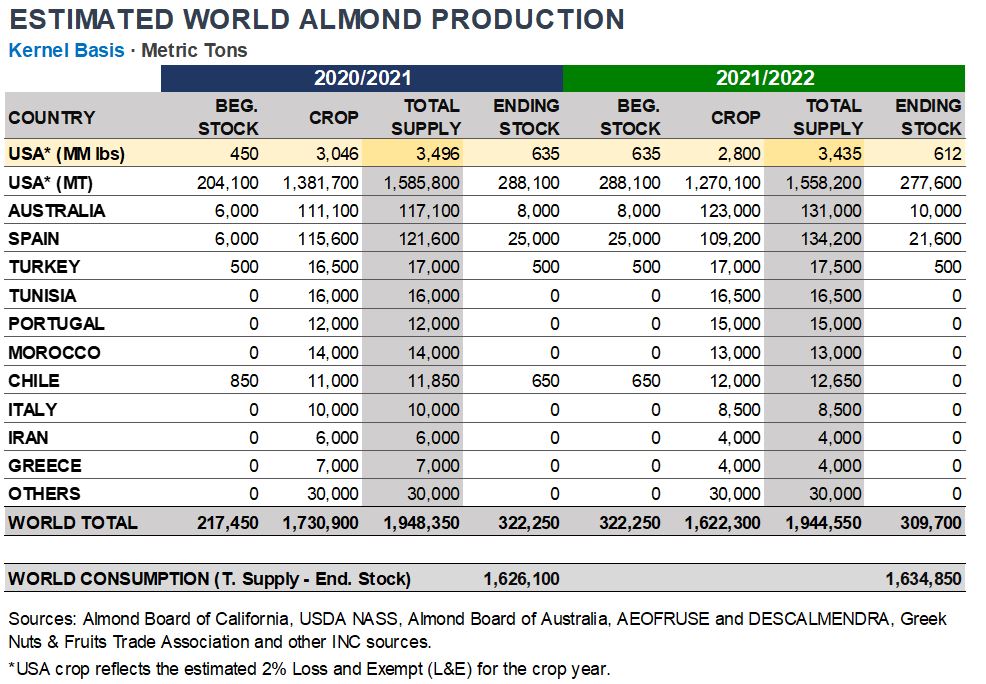

According to the Almond Board of California June 2021 Position Report, published on July 9, receipts through June 30 added up to 3.1 billion lbs. (1.4 million metric tons). Despite the challenges posed by the COVID-19 uncertainties, tariffs and global logistics issues, demand performance has been the highlight this season. Overall shipments through June 30 amounted to 2.7 B lbs. (1.2 MM MT), up by 22% from 2019/20, with significant international shipments of 1.9 B lbs. (876,000 MT), increased by 30%. A phenomenal growth was observed in all regions. Asia-Pacific led the increment (42%), being India and China the two fastest-growing markets. Up by 31%, the Middle East/Africa continues to be very strong. Increment in Europe (20%) is led by strong snacking and domestic demand.

As per the USDA NASS 2021 California Almond Objective Measurement Report (released July 12), the objective crop forecast stands at 2.8 B lbs. (1.3 MM MT), 13% down from May’s subjective forecast and based on 1.3 MM bearing acres (538,200 hectares). Although bloom conditions were excellent, the lack of spring rainfall and record high temperatures in June resulted in lower than initially expected output.

As per the USDA NASS 2021 California Almond Objective Measurement Report (released July 12), the objective crop forecast stands at 2.8 B lbs. (1.3 MM MT), 13% down from May’s subjective forecast and based on 1.3 MM bearing acres (538,200 hectares). Although bloom conditions were excellent, the lack of spring rainfall and record high temperatures in June resulted in lower than initially expected output.

Almonds Australia

The 2021 harvest was completed after a slow start in the eastern growing region because of rain. Based on hulling and shelling results, quality and kernel yield are better than last year. The first six months shipments are expected to be well above last year’s slow start to the marketing year, provided shipping containers are available.

Regarding the outlook for the 2022 crop, chill hours are adequate with bloom to commence in July. Water storages continue to fill with good recent rain events. Nursery sales indicate that new plantings have significantly slowed down, to around 1,000 hectares in 2020. This slowing is likely to continue due to lack of water security and reduced grower returns from a stronger Australian dollar and lower world prices.

Despite the large Californian crop and market disruptions related to COVID-19, exports of 76,710 MT were very similar to the previous year (up 0.2% from 2019). In 2019, 73% of the crop was shipped in the first 6 months, from March to August, while in 2020, only 50% of the crop was shipped within the first six months. This resulted in a larger than normal overlap of the southern hemisphere crop being marketed at a similar time to the northern hemisphere crop. Domestic demand was up 7%, led by the pandemic lockdown.

Regarding the outlook for the 2022 crop, chill hours are adequate with bloom to commence in July. Water storages continue to fill with good recent rain events. Nursery sales indicate that new plantings have significantly slowed down, to around 1,000 hectares in 2020. This slowing is likely to continue due to lack of water security and reduced grower returns from a stronger Australian dollar and lower world prices.

Despite the large Californian crop and market disruptions related to COVID-19, exports of 76,710 MT were very similar to the previous year (up 0.2% from 2019). In 2019, 73% of the crop was shipped in the first 6 months, from March to August, while in 2020, only 50% of the crop was shipped within the first six months. This resulted in a larger than normal overlap of the southern hemisphere crop being marketed at a similar time to the northern hemisphere crop. Domestic demand was up 7%, led by the pandemic lockdown.

Almonds Spain

The final 2020/21 crop is estimated at over 115, 000 MT based on 587,000 ha. Carry out is larger than last year, due to the decrease in domestic demand caused by the lack of tourists entering and consuming within the country. It is estimated that an average of 80 million (pre-pandemic) visitors a year consume around 10-15,000 MT of almonds. Total shipment demand in 2020/21 amounted to 96,633 MT, up 16% from 2019/20, from which 57% were international shipments and the remaining 43% were domestic sales.

Although bearing hectares in 2021/22 (607,600 ha) increased by 4% from last year, the crop is expected to be 6% down, as a very severe frost in mid-March affected the production.

Based on a yearly cultivation of around 15 million trees and 100,000 non-bearing hectares, Spanish almond production is projected to reach 185,000 by 2025. Although around 85% of the planted area in Spain is rainfed, the 15% planted under irrigation is already producing 50% of the total crop.

Although bearing hectares in 2021/22 (607,600 ha) increased by 4% from last year, the crop is expected to be 6% down, as a very severe frost in mid-March affected the production.

Based on a yearly cultivation of around 15 million trees and 100,000 non-bearing hectares, Spanish almond production is projected to reach 185,000 by 2025. Although around 85% of the planted area in Spain is rainfed, the 15% planted under irrigation is already producing 50% of the total crop.