USA: According to the Almond Board of California, the second report of the 2023/24 crop year shows receipts of 625.4 million pounds (approx. 283,700 metric tons) of kernel weight through September 30, 2023. August and September receipts were 73% and 36% lower than 2022, respectively, due to a delayed start to the harvest after moderate weather conditions during much of the growing season. The beginning of the harvest saw some weather events which further altered typical harvest progression and could have crop quality implications. With lower year-to-date receipts, more time will be needed before any meaningful assessments of the 2023 crop can be made.

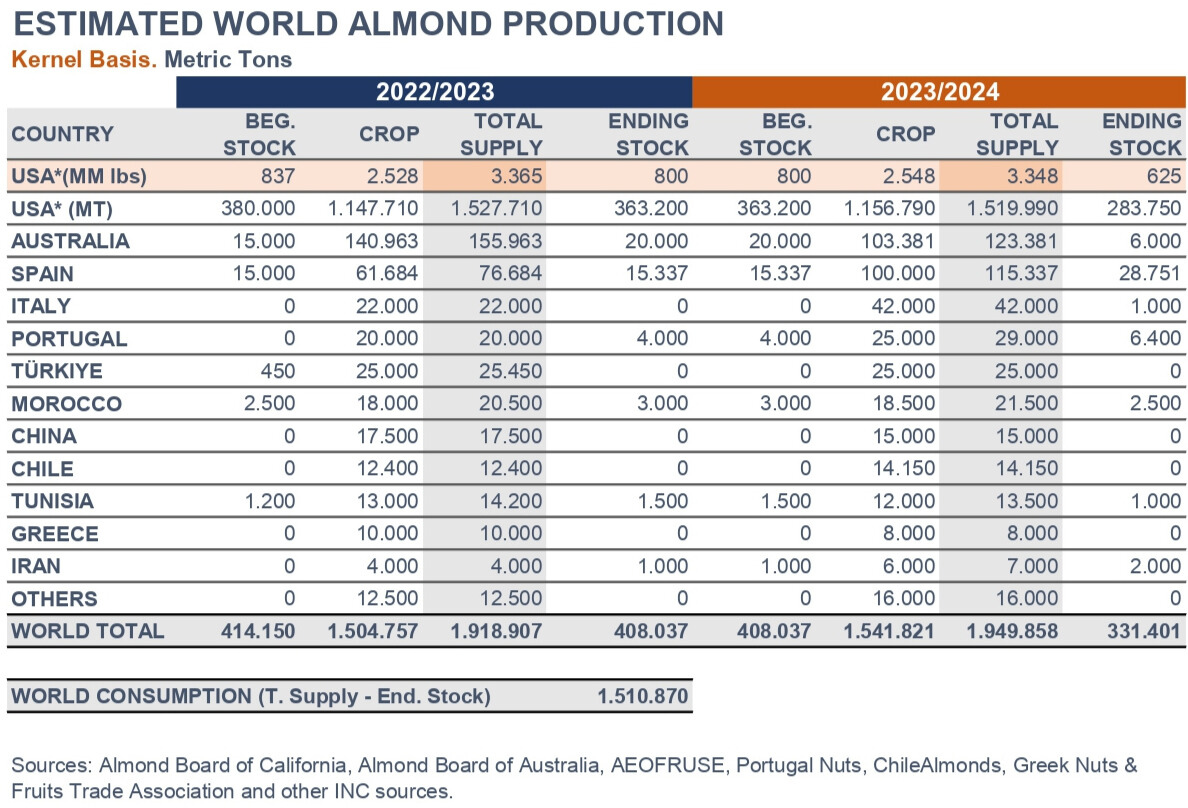

Total shipments in 2022/23 represent the third-largest shipment year in history at 2.565 billion lbs. (approx. 1.163 M MT). With carryout from 2022/23 at 800 M lbs. (approx. 363,000 MT), total supply for 2023/24 is estimated to be 3.348 B lbs. (approx. 1.520 M MT), which is lower than the 3.365 B lbs. (approx. 1.528 M MT) in 2022/23. Domestic shipments in August and September 2023 were up 6% vs. 2022 and export shipments of 305 M lbs. (approx. 138,500 MT) were up by 2%. Export markets in India, the Americas and Western Europe started the new marketing year strongly with gains of 32%, 10% and 9%, respectively.

Australia: According to the Almond Board of Australia, the almond industry has suffered an unprecedented drop in yield this season, down around 30% on pre-season estimate, to 103,381 MT (kernel weight equivalent). A shortage of beehives due to biosecurity controls along with poor pollination weather started a growing season that was full of climatic challenges for growers. While the trees benefited from a mild and above-average rainfall, that promise did not translate into a strong crop set and processors reported low crack-outs and a high incidence of blanks during harvest.

The industry has released its first comprehensive LandIQ spatial mapping report, with the total number of hectares now at 62,412, up almost 2,000 ha on the previous grower-surveyed result. The eastern growing region of Riverina in New South Wales has emerged as the second largest growing area.

Expectations for the next season are optimistic, pollination season resulted in one of the best blooms growers can recall and has the industry anticipating a strong bounce back in production early next year. Almond Board of Australia projections and LandIQ planting data suggest that the 2024 crop could meet long-range forecasts of 175,000 MT.

Demand for Australian product remains strong, with exports up almost 50% in the first four months of the new season. A new trade agreement has lifted sales to India by 111% on the previous season, while manufacturing markets like Spain and Türkiye are also significantly up.

Spain: Hot temperatures in spring and summer impacted the potential of the 2023 crop. At the time of writing this report, kernel sizes were expected to be much smaller due to poor fruit development, and yields per hectare much less than the May estimate suggested, leading to a smaller crop than anticipated. As a result, larger sizes are expected to fetch a higher premium.

Dry farming was the most impacted, but irrigated orchards are also showing the signs of stress as they face the challenge of reduced water allocations.

Portugal: According to Portugal Nuts, the new higher-yielding irrigated orchards are seeing output levels slightly below expectations, with smaller sizes and kernel yields than last season, but good quality. Low water allocations in the region are among the main reasons for these results. All in all, the crop increase is due to new orchards coming into production.

Related Articles

Nothing found.