USA (California)

The second Almond Board of California Position Report of the 2022/2023 crop year (August 2022-July 2023) showed receipts of 978.5 million pounds (approx. 443,850 metric tons) of kernel weight through September 30, 2022, 8% lower than in 2021. However, at the time of writing this report, it is still too early to determine if the estimated 2.6 billion lbs. crop (1.180 million MT) forecasted by the USDA would be realized, it will depend on the actual receipts as the remaining months of harvest, hulling and shelling progress.

Overall shipments in 2021/22 were the second largest in history at 2.634 billion lbs. (≈1.195 million MT) even amidst the logistical issues. Nonetheless, as reported by industry sources, demand has been sluggish during summer. Buyers were discouraged by the large carryover and the strong US dollar. From the seller’s standpoint, prices could not keep up with the rising cost of water, energy and agrochemicals Pricing remained fairly stable during September as the dollar kept strengthening and inputs costs continued on the rise.

Shipments were strong in August —assisted by the significant carryover, numerous cargoes of the old crop were shipped— while in September, with the smaller crop being harvested, total shipments lagged as compared to 2021. Export shipments in September amounted to about 137 million lbs. (≈62,000 MT), down 16% from the prior year. On a year-to-date basis, helped by the August record, exports added up to nearly 300 million lbs. (≈136,000 MT) through September, just about -1.6% vs. 2021. Export markets in the Middle East/Africa and Europe started the new marketing year strongly, with gains of 103% and 6%, respectively. Domestic shipments in September (52 million lbs./23,500 MT) were down 19% and below 10% YTD (117 million lbs./53,000 MT) vs. 2021.

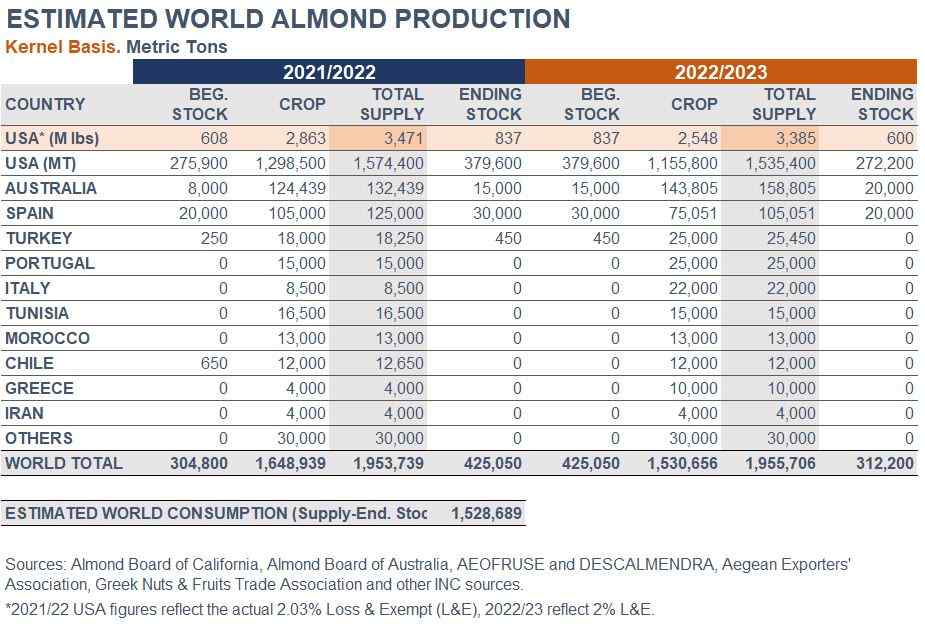

With carryout at 837 million lbs. (≈ 380,000 MT), total supply for 2022/23 is estimated to be 3.385 billion lbs. (≈ 1.535 million MT), slightly below 2021/22.

Australia

According to the Almond Board of Australia, the latest crop estimate for 2022 is 143,805 MT, slightly down on the pre-season estimate of 145,000 MT, but 3.7% up on the June estimate. The wet weather has hampered the harvest, hulling, and shelling operations, but the latest figure indicates that processors have still managed to salvage a crop that has defied mid-year concerns of a reduced volume of saleable product. In-shell volumes were significantly down in India (55%) because of the lack of product available due to the wet weather and the premium paid by China for the same product. China sales are 23% up in the first five months of the season on last year, while Europe is up 4% and Middle East 29%. Overall export and domestic sales are down 7% despite prices at 10-year lows.

The crop potential for 2023 was hampered by a varroa mite incursion on commercial beehives in northern NSW in June, which restricted beehive movements on the eastern coast and resulted in some orchards in Victoria not receiving their desired hive stocking rates during bloom. The impact on the yield remains unclear. Growers continue to face high input costs and exporters are still dealing with sea freight costs well above pre-COVID-19 levels, which further erodes farmgate returns.

Spain

A spring frost event, poor pollination and the torrid summer seemed to have impacted volumes and sizes. Most of the almond-producing regions had completed the harvest by mid-September; and the remaining areas were over 85% harvested. Cleaning and drying started while waiting for a better price positioning. Demand in Europe was slow, summer sales were weak and there is some concern regarding Christmas sales.

Related Articles

Nothing found.