Brazil Nuts Crop Progress Report

Over 2020, like the rest of the world, South America has also faced the global pandemic. For the Brazil nuts industry, this meant the starting and stopping of production, which affected yields. Falling prices through the year resulted in all factories ending up losing money as they were forced to cover raw material at the start of the crop when prices are higher. Port difficulties, with lack of containers and vessels missing port, were also worsen last year. And all of this amidst political turmoil in Bolivia as the government changed twice from an interim government followed back to the original party after a second election.

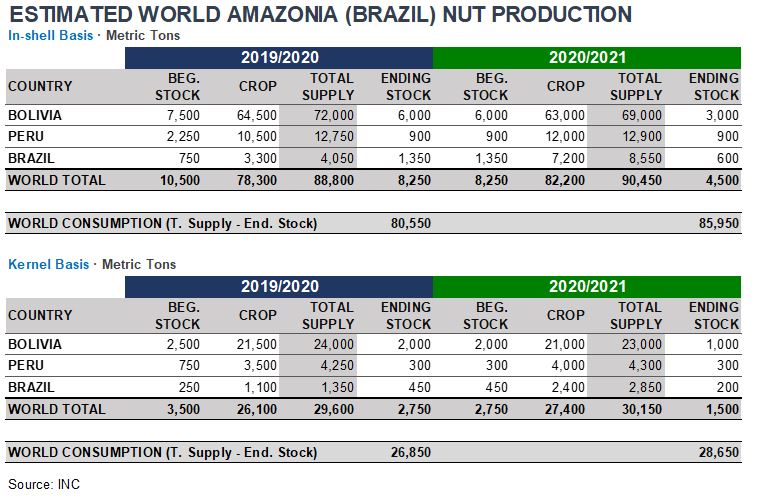

While volumes exported started low and had months well below average, bumper months in September, October & November pushed exports level back to normal. Total exports from South America in 2020 added up to around 31,000 metric tons (Bolivia, 77%, Peru, 13% and Brazil, 10%); up by 10% from 2019. The total value though was fairly below the last years’ average.

By the beginning of 2021, carryover was short as yields were lower than what factories had anticipated. Raw material started to be negotiated at levels above the ending export price of 2020. Initially, exporters pushed back but intervention with the assistance of the government eventually set pricing at that higher level. Thus, exporters who had made a few speculative sales of 2021 withdrew from the market to cover that material as raw material no longer supported that price.

Going forward, shippers are likely to stay withdrawn until more raw material flows from the forest to the factories. Some markets for Brazil nuts are well covered already, but the smaller users, who buy every few months, are not. Smaller shippers, who buy material and then sell against the raw material replacement price, may start to push up the export prices with buyers who are in need of stock and, in turn, will start paying higher prices for raw material.

While volumes exported started low and had months well below average, bumper months in September, October & November pushed exports level back to normal. Total exports from South America in 2020 added up to around 31,000 metric tons (Bolivia, 77%, Peru, 13% and Brazil, 10%); up by 10% from 2019. The total value though was fairly below the last years’ average.

By the beginning of 2021, carryover was short as yields were lower than what factories had anticipated. Raw material started to be negotiated at levels above the ending export price of 2020. Initially, exporters pushed back but intervention with the assistance of the government eventually set pricing at that higher level. Thus, exporters who had made a few speculative sales of 2021 withdrew from the market to cover that material as raw material no longer supported that price.

Going forward, shippers are likely to stay withdrawn until more raw material flows from the forest to the factories. Some markets for Brazil nuts are well covered already, but the smaller users, who buy every few months, are not. Smaller shippers, who buy material and then sell against the raw material replacement price, may start to push up the export prices with buyers who are in need of stock and, in turn, will start paying higher prices for raw material.