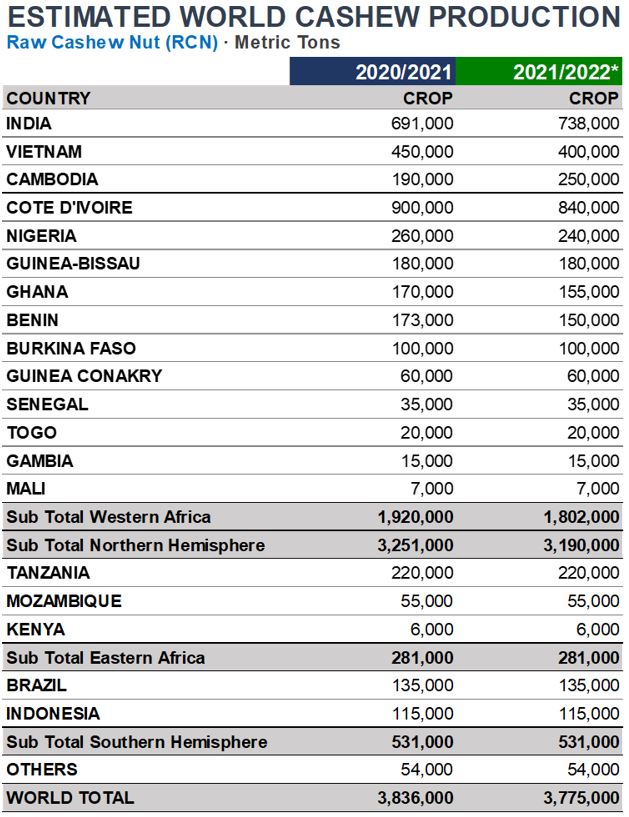

The total crop for the 2020/2021 season is estimated at 3.8 million metric tons, and the 2021/22 crop, is expected to be very similar to the previous season. The difference is about a 2% reduction in the crop size, primarily on account of the lower estimated crops in West Africa (down 6% from 2020/21) and in Vietnam (down 11%), which are being compensated, to some extent, with a good crop in Cambodia (up 32%). The main decreases in West Africa are forecasted for Côte d’Ivoire (7%), mainly due to drought, Nigeria (8%), Ghana (9%), and Benin (13%). No changes are anticipated for the rest of the origins.

The main challenges that the industry was facing, at the time of writing this report, were related to the logistic issues affecting the whole goods transportation industry. In Africa, containers and vessels availability were hampering the raw material flow towards the Asian processors, while kernels shipments from Asia to Europe were also slowed down since October last year. At this time, shipping rates started to raise and kept following that trend towards the first semester of 2021. The availability of kernels almost stopped in Europe and was very limited in the US.

In spite of the disruption in the movement of raw material into India and Vietnam, due to the domestic crop's harvest, there was not yet a shortage of raw cashew at the processing facilities. However, once the nuts got processed, the availability of empty containers was low, getting a booking extremely difficult, the freight rate was excessive and the transit times had expanded. Even upon arrival, there were difficulties to transport the containers to warehouses as trucking rates, in the US and Europe, had gone through the roof.

On the demand side, during the first quarter of 2021, imports into Europe and the US were increased between 3 to 7%, as the demand for cashews was still going up. Due to the lesser kernel availability from Asia, prices are likely to at least stabilize, or even go up. The price trend seems to show the beginning of a price recovery in 2021 after a stiff decline in 2019 and 2020. In India, demand, which has been heavily affected by COVID-19 last year, is anticipated to improve in the second half of this year.