North America Pecans Crop Progress Report

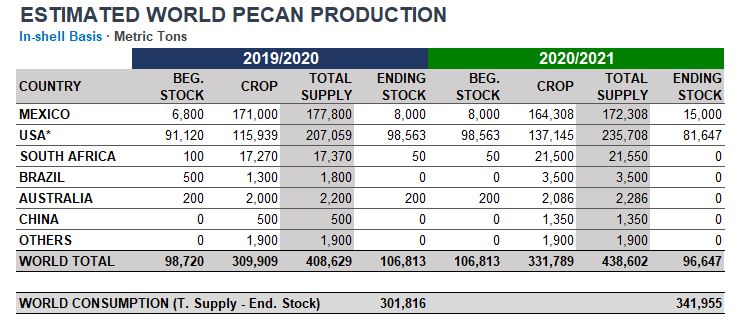

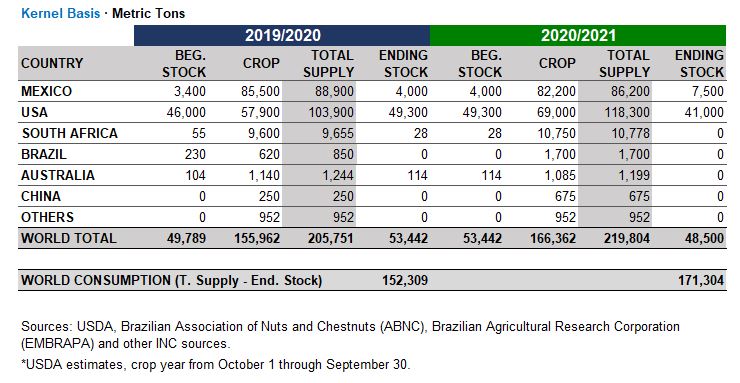

On January 21, 2021, the USDA released their 2020 preliminary crop production forecast projecting a final crop of 137,145 metric tons (302.4 million pounds) in-shell basis, slightly below their December estimate but 18% higher than 2019. Conversely, the Mexican Government's final crop is estimated at 164,308 MT (362.2 million pounds), approximately 4% lower than 2019. North American total supply is up 5.7% over the same period a year ago. However, quality issues in Mexico have resulted in shortages in key supply segments, specifically Fancy Mammoth Halves, Fancy Jr. Mammoth Halves and Fancy Extra Large/Large Pieces.

Shipments continue to be robust, both domestically and internationally. With increased interest from China and the EU, overall US pecan exports are up 7.6%. In-shell shipments to China are up 72% over 2019 levels. Mexican exports, while holding relatively steady to China, are down approximately 24% to the US primarily due to quality issues. With the highest production levels in Georgia since 2012, even major Mexican shellers have turned to Georgia to procure good quality low count in-shell. As such, prices have started to firm for the first time in four years. Although there is still a considerable price gap between pieces and halves, piece prices have also started to climb. With most major buyers having already booked at lower levels, consumption is expected to continue to be good for the remainder of 2021.

Shipments continue to be robust, both domestically and internationally. With increased interest from China and the EU, overall US pecan exports are up 7.6%. In-shell shipments to China are up 72% over 2019 levels. Mexican exports, while holding relatively steady to China, are down approximately 24% to the US primarily due to quality issues. With the highest production levels in Georgia since 2012, even major Mexican shellers have turned to Georgia to procure good quality low count in-shell. As such, prices have started to firm for the first time in four years. Although there is still a considerable price gap between pieces and halves, piece prices have also started to climb. With most major buyers having already booked at lower levels, consumption is expected to continue to be good for the remainder of 2021.

South Africa Pecans Crop Progress Report

The high tariffs put on the USA pecans into China (47%) along with the overall drop in prices benefited the South African pecan industry, with many buyers shifting to South African products. Estimated sales to China were +-90% of the crop, leaving little for the local market or other marketing options.

The 2021 harvest is expected to be between 22,000 and 24,000 MT, depending on the first semester climatic conditions.

The 2021 harvest is expected to be between 22,000 and 24,000 MT, depending on the first semester climatic conditions.

Brazil Pecan Crop Progress Report

Season 2020/21 is expected to be an on-year. In spite of below-average rainfall in some regions, spring and summer conditions are pointing to a good harvest: there were no rain disruptions during flowering, which was abundant, and fruits were developing well.

Australia Pecan Crop Progress Report

Consumption of the domestic crop is primarily within Australia and New Zealand, and as the crop volume contracted last season as a consequence of continued drought, this concentration was further extended. Exports of both pecan in-shell and kernels are down.

China Pecan Crop Progress Report

Due to new plantings coming into production, the 2020 production ended up much larger than anticipated. Expansion of the planted area is expected to continue in the coming years. Although in-shell market still prevails, kernel demand is growing in seasonal sales such as the Moon Festival and the Chinese New Year.