USA

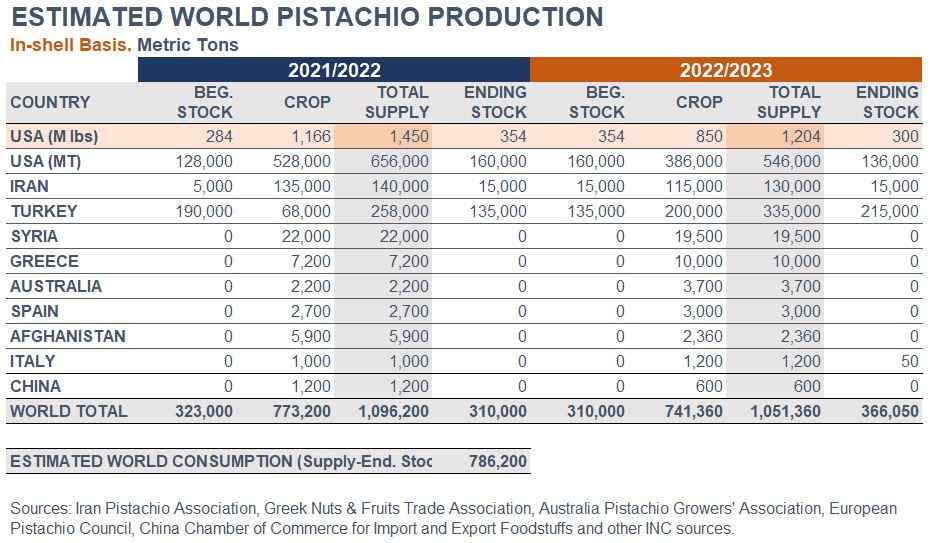

As the California 2022/23 harvest was slowly ramping up towards the end of September, early indications were projecting a significantly smaller crop of around 363-409,000 metric tons (800-900 million pounds). High heat and drought conditions are expected to negatively impact quality, with harvest indicating increased closed shells and additional staining.

Global demand is anticipated to remain strong, with US shipments the past crop year over 379,000 MT (837 million lbs.) driven by strong exports, a 17% increase from the year before. As processors got ready for the Mid-Autumn Festival and Chinese New Year, the Chinese market started to picked up.

Several factors affecting sales last year are continuing to be challenges this year: additional tariffs between China and US with increased quality requirements, and shipment and logistic issues creating delays and near-term shortages.

Iran

As reported by the Iran Pistachio Association, total exports for the 2021/22 marketing year amounted to 105,000 MT (in-shell equivalent), 31% below the past four years average, and accounted for 75% of the marketable inventory. Year-to-date kernels and green kernels export shipments amounted to 16% (24% including closed shell as raw material for kernels) of this year’s share, against 11% for the same period last year. Domestic consumption was estimated at 20,000 MT, around 14% of the total inventory.

The higher than previously expected remaining inventory (15,000 MT) was due to a sluggish supply, resulting from a spring frost in southern provinces and government control over the official exchange rate against the US dollar during the second half of the MY.

IPA’s 2022 pre‐harvest forecast stands at 115,000 MT of dried in‐shell pistachios. The post-harvest estimate will be published in November. Long varieties are expected to account for 65% of the new crop, as a higher share of it is coming from new producing regions, where the long varieties are dominant.

Global demand has been under pressure due to the price disparity between domestic and global markets. This disparity is decreasing for the new crop to move to global markets. Worldwide demand for natural pistachio kernels remains strong due to their quality and price competitiveness.

Turkey

At the time of this writing, harvest was ongoing and meeting the initial expectations of a big crop, which is forecasted at 200,000 MT. Pistachio farmers keep investing on quality and post-harvest infrastructure systems. Currently, a running huller station can be found in each big village, allowing growers to harvest early varieties. These new developments have negatively affected the market for processors since the immediate raw material delivery pressure has been lifted off from growers’ shoulders. Currently, the bottleneck for the entire sector is the supply of raw material to the market because of the flexibility that growers have. These developments will support the Turkish pistachio in the long term, but nowadays prices are far away from being competitive as they have reached their summit this season.

Australia

Total domestic demand for the FY2022 (ended June 30) was down 18% over the COVID-19 boom years of FY2020 and FY2021. Winter chill has been adequate for the spring flowering and 2023 is expected to be a good off-crop especially with new orchards coming into production. Further planting occurred over winter.

Spain

The 2022 crop estimate was revised down from the previous forecast, due to blooming and ripening problems, owing to late frosts and drought during late spring and summer seasons.

Prices at the orchard level have dropped down due to higher costs, especially electricity and fuel, at the processing level. The whole value chain seems to be narrowing down its margins.