Türkiye

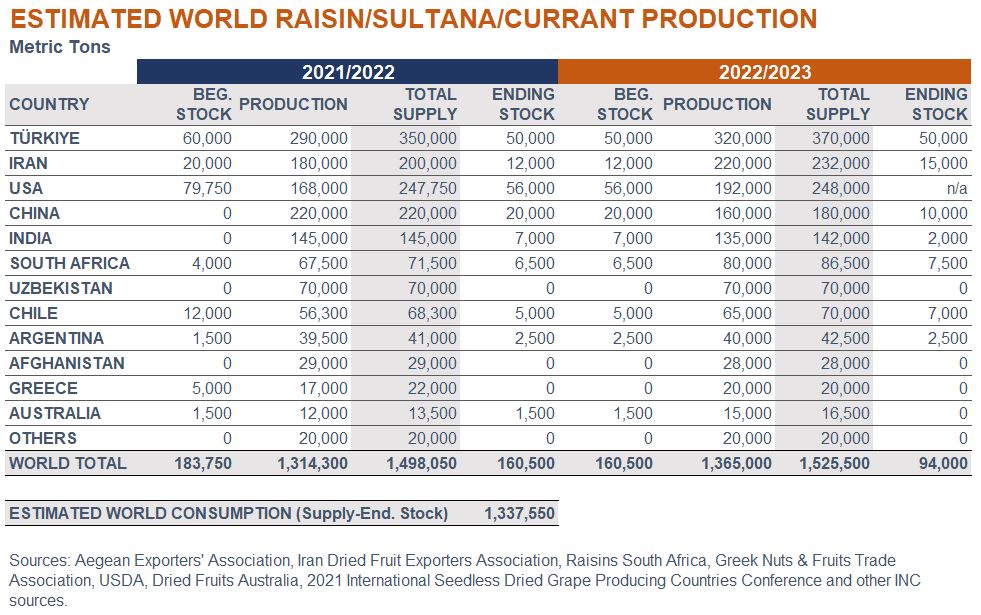

As reported by the Aegean Exporters’ Association, Sultana raisin production for 2022/23 is forecasted at 320,000 metric tons, up by 10% from 2021/22.

Exports from September 1, 2021 through August 31, 2022 reached 252,000 MT, an increase of 11% compared to the 2020/21 marketing year. New crop shipments year to date (September 1-October 1, 2022) amounted to 25,300 MT, down by 11% from the same period the prior season.

USA

The raisin growing region in California experienced favorable growing conditions during the spring and summer months. Bloom started in early May with the bunch count being on the average side. Some raisin growers were affected by the rain event that occurred in mid-September, but overall, the quality is expected to be good.

September and October are busy months for the California raisin industry with harvest and with fall baking, and holiday seasons just around the corner. Congestion at the ports is an ongoing issue with many export orders arriving at destinations later than scheduled.

According to the U.S. Census Bureau Trade Data, exports over Q1 and Q2 2022 amounted to 41,300 MT, 10% down from the same period in 2021. Japan and Canada remained the main destinations, accounting for 34% and 12% of the total share, respectively. Exports to China added up to 5,300 MT, 26% up from 2021. Imports, on the other hand, increased 54%, reaching 12,000 MT. The main origins were South Africa, with 41% of the share, Chile (30%) and Argentina (11%).

China

According to industry sources from the Xin Jiang raisins market, the 2022 production was anticipated to be normal. However, after harvesting, the initial expectations were not met and less quantity was produced due to smaller sizes and lighter weight of the raisins.

At the same time, pricing last year dropped to less than $1.5/kg, the same level of 20 years ago, therefore many growers have switched to other products or tried to sell a higher share of the crop as table grapes (about 30%), leaving less quantity available for raisin production. The quality of green raisins was also poor. Due to this shortage in quantity, at the time of this report, prices had increased by 3-5% and were expected to be kept at this level, boosting growers’ confidence.

All in all, this year’s production was revised down to 160,000 MT, while the carry-in inventory was reviewed up to 20,000 MT. Carry-out stock is expected to be lower and it is estimated at around 10,000 MT.

As per the Chinese Customs Database, 2022 imports (January-August) added up to 14,245 MT, being Uzbekistan and Chile the top origins, with 54% and 19% of the share respectively. Chile, USA, Türkiye, Australia, Greece and South Africa accounted for the remaining 27%. Exports for the same period amounted to 10,000 MT, with the UAE accounting for 25% of the share, Japan 13% and Mongolia 11%.

South Africa

According to Raisins South Africa, the industry was hampered by above-average rainfall that significantly reduced the 2021/22 crop size, by 20%. Exports have been negatively impacted by the global shipping issues. From the production standpoint, there is concern about the current inflationary pressure, with energy, labor, fertilizer and other inputs costs increasing by double digit numbers.

By the time of writing this report, the current crop was progressing well. As the producing regions entered spring, some cold weather was experienced in mid-September, but no frost damage was reported. A first official crop estimate will be announced on November 30, 2022 for 2022/23.

Related Articles

Nothing found.