China Walnut Crop Progress Report

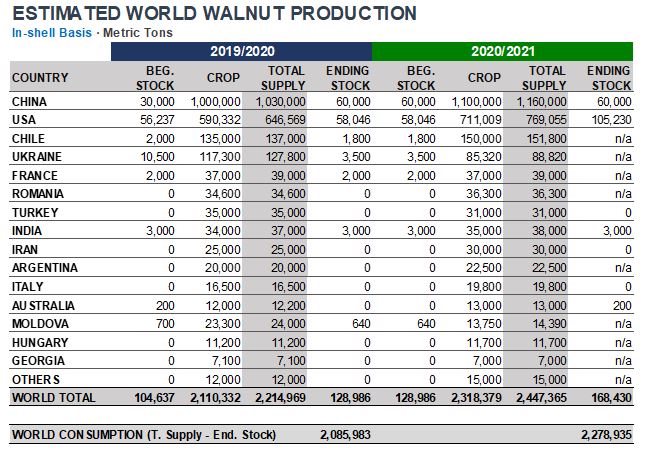

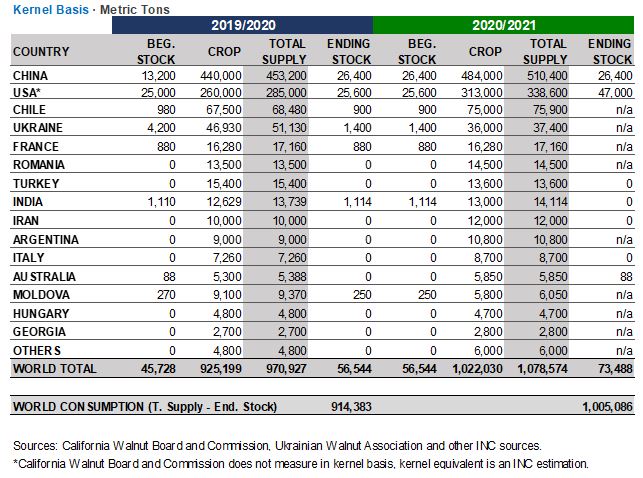

Despite crop failure in the north, owing to the increased production in Xinjiang and Yunnan, the final receipt is estimated at 1.1 million metric tons (in-shell basis). Quality is fair and good.

Overseas shipments are not as strong as last season due to a lack of containers for both ocean and land transport. The high freight rate coupled with unfavorable currency exchange has refrained exports from increasing. While anticipating robust local consumption, led by roasted nuts retail and the Chinese New Year’s demand, the industry will try to achieve stronger exports at lower pricing later on in the season.

Overseas shipments are not as strong as last season due to a lack of containers for both ocean and land transport. The high freight rate coupled with unfavorable currency exchange has refrained exports from increasing. While anticipating robust local consumption, led by roasted nuts retail and the Chinese New Year’s demand, the industry will try to achieve stronger exports at lower pricing later on in the season.

USA Walnut Crop Progress Report

The California Walnut Board reported handler receipts, as of December 31, 2020, of 783,754 short tons (711,009 MT). The final crop number will be reported later in the year.

Overall, market demand remains strong driven by increased use at home. Shipments through December 31, 2020, for both in-shell and shelled, have been robust in the Middle East and Africa, showing combined gains of over 30%. With an April Ramadan, shipments are expected to remain strong. While Asian overall demand is increased, many European markets, due to the ongoing pandemic and varying restrictions, are slightly down as compared to the prior year.

In response to strong retail sales in the US and Canada, in-shell and shelled shipments have increased during the first four months of the crop season.

Overall, market demand remains strong driven by increased use at home. Shipments through December 31, 2020, for both in-shell and shelled, have been robust in the Middle East and Africa, showing combined gains of over 30%. With an April Ramadan, shipments are expected to remain strong. While Asian overall demand is increased, many European markets, due to the ongoing pandemic and varying restrictions, are slightly down as compared to the prior year.

In response to strong retail sales in the US and Canada, in-shell and shelled shipments have increased during the first four months of the crop season.

Chile Walnut Crop Progress Report

Rainfall during winter 2020 was higher than the previous year, still below the historical average, but with a good accumulation of snow, which has allowed normal water availability. However, as the stress caused by the long-standing drought from the previous season is still affecting tree productivity, Chilenut has preliminary adjusted the initial forecast of 164,000 MT in-shell basis 8.5% down to 150,000 MT.